Popular hashtags for trading blogs

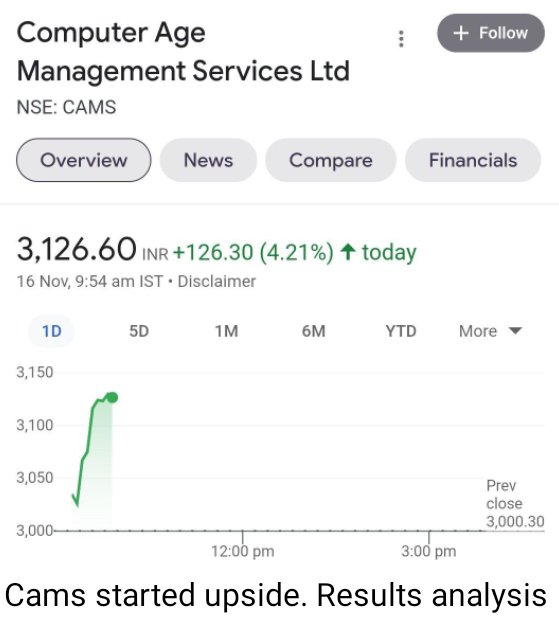

Stocks in action :-

Why i take instant loan from “Navi” ?

Last two months onwards trying to learn basics about stock market , practicing buying and selling of stocks thought paper trading , watching youtube videos, following news related to stock market,one fine day i feel the things you learnt must keep in practice,so i want some amount to trade ,one day while watching youtube videos i seen advertisement about “Navi” application than i decided to apply for it , installed “Navi” application from “Google Play Store”,select “personal loan” option started filling the application,they offered me 34000₹ loan for me,but i decided to take the loan amount which should not exceed above the monthly salary of myne,so applied for a loan amount of 17000₹

Steps for applying loan from “Navi”:-

1. Personal details.

2. Adhar number,PAN card number,Bank details,Note:- mobile number should be linked to adhar number,

3. Six months bank statement in“ PDF ” format only accepted .

4. “Navi” application send “1₹” to your bank account to verify your bank account details.

5.Make a video call to “Navi” coustomer care personal before calling get ready with original documents like “PAN, ADHAAR”.After lifting the call “Navi” customer care person ask your name,phone number, original documents than you have to show documents with clarity ,than they will take your photo from front cam,

6. Than application ask your perminent address to fill when it is your perminent, present address is different,then they will present adress proof like electricity bill as proof.

7 . Then they will transfer the amount to your bank account with in one minute.

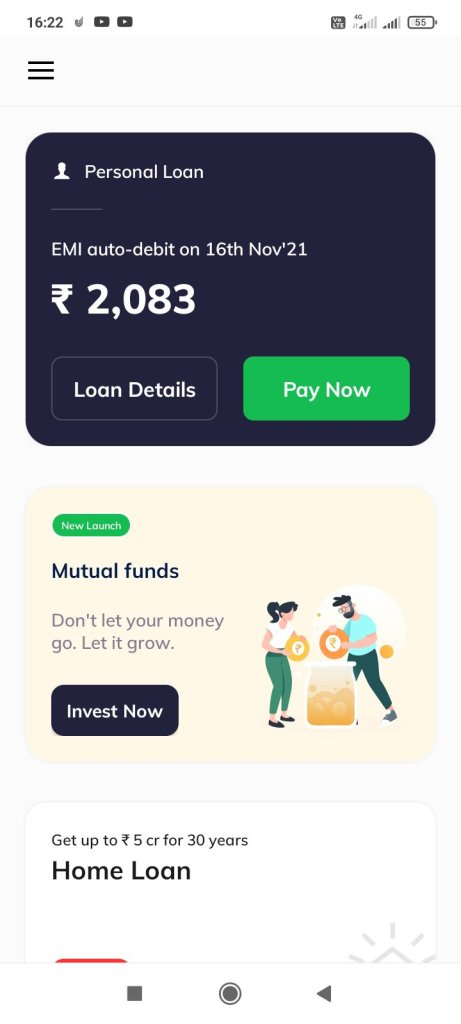

Loan details:-

As said above i applied for 17000₹.

I received amount of 15231₹ .

They charged 1499₹ as processing fees.

Tax:- 269₹.

Total charge including GST:- 1769₹.

Intrest rate :- 24% per annum.

Monthly EMI:- 2083₹ .

Total EMI’s to pay :- 9 months .

Late pay of EMI more than three days 800₹ they will charge,bounce fees balance nill in bank account 500₹ they will charge.

My story:- i am planning to pay the monthly EMI’s , earning through intraday trading. Just wait what will happen i will be succed or not.stay tune with my logs updates please follow me,Thank you for visiting my blog & supporting me.

It is conducted for an hour on the occasion of “Hindu festival Diwali or Deepawali” that makes the beginning of samvat 2078 the hindu new year,

Additionally is a way to tribute to “Goddess Laxmi (Hindu deity of property and wealth),it was begin by “BSE” in 1957 ,while the “NSE” made it regular from 1992, According to experts the muhurat is a devoted occasion for investors,they believe deals end up give fruitful results which leads to prosperity and wealth,As astrologically defined auspicious moment of the day.

Every year session will begin at 06:15 pm and closed at 07:15 pm.special trading window opend after Hindu panchang marks it as the beginning of new samvat.people who invest believe that muhurat session may bring wealth and prosperity throughout the year.

Pre-opening begins between 06:00 pm and 06:15 pm,The Equities, Equity F&O,Currency F&O, commodities executed between 06:15 pm and 07:15 pm ,the closing will be between 07:25 pm and 07:35 pm.

Mid and small cap stocks for diwali CLICK this link Diwali stocks to watch

Happy Diwali for all ,thank you for visiting my Blog.

My mistakes My corrections:-

At my first trail , while doing intraday trading.

1. choose the stocks in which you are going to invest,how much quantity your going hold add that much amount to your Dmat account one hour before trading.

2. At first attempt use After market order option to execute your order (don’t forget to add sufficient funds to your demat account).

3. Prepare your own strategy at which point you exit from the market,(please note down at which point you entered into the market.

4.Exit the market at your point of time,no matter how the market is tempting you.

5. Eliminate your emotions, grasping for money.

6.Time matters much while dealing with intraday trading ,you must have free time

My story:- One fine day i recieved my salary 20k ,That day i hear positive news about Adani green energy shares going to impact the market positively ,so I decided to buy 10 shares it is around 10k,that time i was on duty ,busy at work I entered the market hours 20 minutes late in that span it gone 45₹ up , even though i decided to entered into market , exit the market with 9₹ profit per share ,10×9=90; Actual profit to gain :- 10×54=540; Time matters lot (That’s why “Time is money”).